Finance with foresight. Property with purpose.

Money Brain helps Australians structure finance and property portfolios so every decision builds lasting wealth.

Philosophy

Finance is more than numbers on a page — it’s the tool that unlocks opportunity. The right loan doesn’t just fund a property; it fuels your journey toward lasting wealth. Every decision is a step forward, shaping both your portfolio and your future.

At Money-Brain, we see finance as a roadmap. We keep you informed at every stage, showing you what’s possible and guiding you toward the highest and best use of your resources. Together, we focus not only on the next property but on the bigger picture — building a portfolio designed to achieve your long-term goals.

Who We Help

Tailored strategies for every journey. Property is personal. Every journey is different, but the goal is the same — creating wealth and security.

We partner with:

Property Investors

Maximize returns with smart strategies tailored to your goals.

First Home Buyers

Step into the market with guidance at every stage.

Doctors & Nurses

Flexible solutions designed around demanding schedules.

Allied Health Professionals

Secure property opportunities that fit your lifestyle.

Professionals

Strategies aligned with your career and financial goals.

SMSF

Unlock the potential of your super through property.

Self-Employed

Overcome lending challenges with tailored solutions.

No matter where you start, we help you move forward with clarity and confidence.

Roadmap

Confidence at every step

Discovery Call

Begin with clarity. A conversation to understand your position and answer your first questions.

Strategy Map

See the possibilities. A video session with screen share that maps your journey and reveals future options.

Loan Structuring

Build the foundation. Smart loan design aligned with your goals and long-term flexibility.

Ongoing Roadmap Updates

Stay on track. Every 6–12 months we review, refine, and adjust — ensuring you’re always positioned for the best outcome.

Client Journeys

Real stories. Real portfolios. Real results.

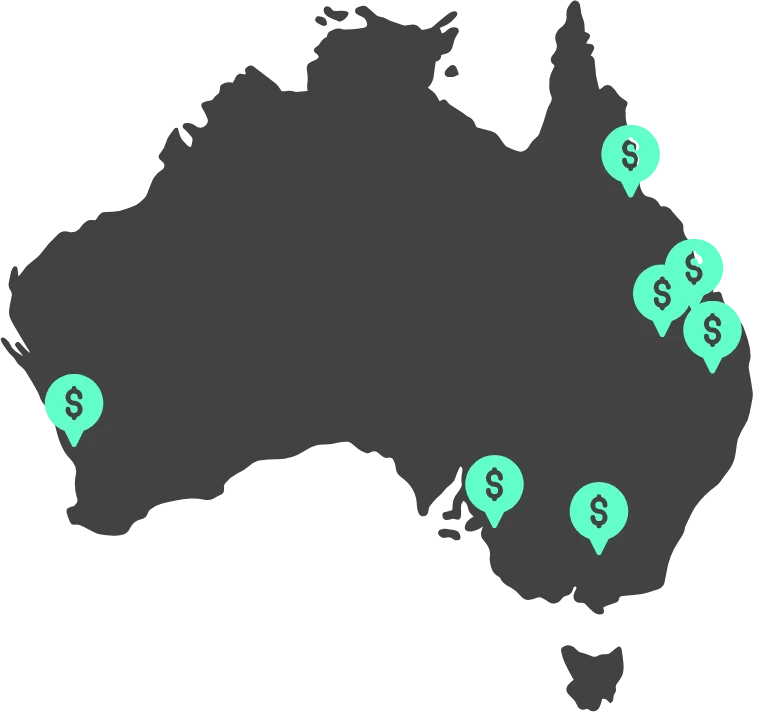

- Income: $165,000 (combined)

- Timeframe: 54 months

- Portfolio: $3.818M

- Properties: 7

- ROI: 667%

Client Journeys

Real stories. Real portfolios. Real results.

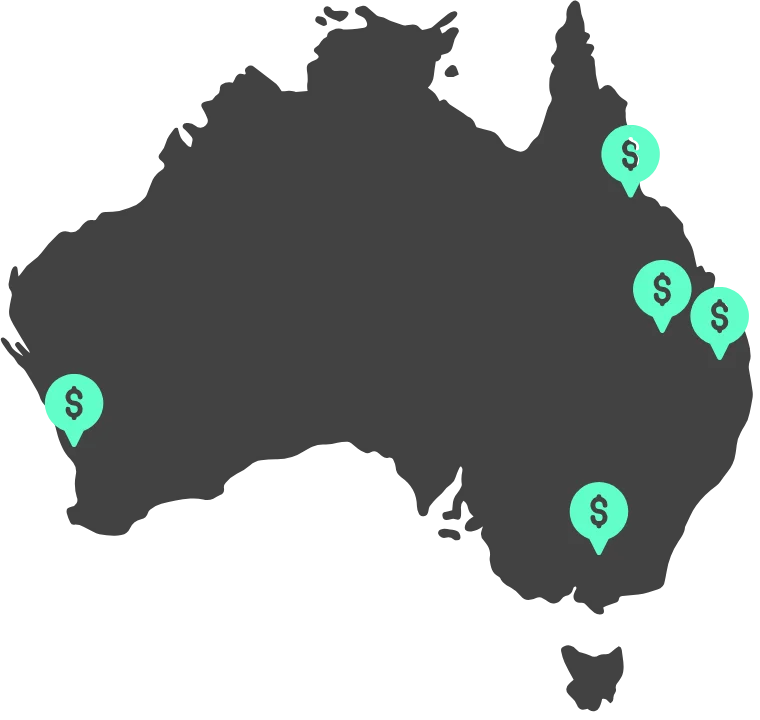

- Income: $85,000

- Timeframe: 68 months

- Portfolio: $2.435M

- Properties: 5

- ROI: 710%

Client Journeys

Real stories. Real portfolios. Real results.

- Income: $65,000

- Timeframe: 30 months

- Portfolio: $1.425M

- Properties: 3

- ROI: 584%

Client Journeys

Real stories. Real portfolios. Real results.

- Income: $165,000 (combined)

- Timeframe: 54 months

- Portfolio: $3.818M

- Properties: 7

- ROI: 667%

Client Journeys

Real stories. Real portfolios. Real results.

- Income: $85,000

- Timeframe: 68 months

- Portfolio: $2.435M

- Properties: 5

- ROI: 710%

Client Journeys

Real stories. Real portfolios. Real results.

- Income: $65,000

- Timeframe: 30 months

- Portfolio: $1.425M

- Properties: 3

- ROI: 584%

Our Edge

Technology that empowers. Humans who care.

AI Technology

Smart tools give you 24/7 portfolio dashboards, loan tracking, and predictive risk alerts — keeping you informed at every step.

Human Strategy

Our specialists design personalised finance and property roadmaps, making sure every move aligns with your long-term goals.

Ongoing Guidance

Regular 6–12 month reviews, proactive refinancing, and equity recycling ensure you never miss an opportunity to grow.

Education First

We explain the “why” behind every recommendation, giving you clarity and confidence to make each decision with certainty

Our Partners

Technology that empowers. Humans who care.

Strategically utilising banks to elevate your wealth is crucial. By understanding how to position yourself effectively, you can maximise success from the very first loan. With the right lender partnerships, you gain the flexibility to expand your property portfolio and accelerate long-term financial growth.

- 40+ trusted lenders across major banks and niche providers

- Tailored lender selection for every client strategy

- Competitive structures designed to support scaling

- Strong relationships that mean faster approvals and smoother outcomes

Insights

Stories of how we help people.

First Home Buyers, Faster

We helped first home buyers understand the exact deposit required — allowing them to purchase their home now instead of waiting years to save more.

Unlocking Equity to Grow Sooner

By obtaining multiple valuations, we helped a client release $80,000 from their property. This allowed them to buy their next home 14 months earlier than planned.

Scaling to a Third Investment

We helped another client release $60,000 and restructure their loans. This gave them the ability to purchase a third investment property now, instead of waiting 12 months with their previous broker.

Dream Home + Lower Repayments

We structured finance so clients could secure their dream home while also reducing repayments on their existing loan — achieving both lifestyle and financial wins.

See Real Success

Why clients trust Money Brain.

Darren made the entire loan process feel effortless. He explained everything clearly, answered every question with patience, and kept us updated the whole way.

We felt genuinely supported from start to finish. Darren explored every option, structured the loan around our goals, and made what should have been stressful completely manageable.

Darren’s knowledge of lender policy is outstanding. He analysed our position in detail and delivered a strategy that suited our investment plans perfectly.

Another broker told us our scenario was too hard. Darren proved them wrong. He went above and beyond, communicated brilliantly, and got us approved.

What stood out most was the trust. Darren genuinely cared about the outcome for our family, not just securing a loan. We’ll be recommending him to everyone.